Dated 2 December 2025

This Instruction reinforces compliance with the accrual accounting basis prescribed under Article 6 of the Law on Taxation, Article 43(1) and Article 59(1) of the Prakas on Tax on Income, and Cambodian International Financial Reporting Standards (“CIFRS”) requirements.A key emphasis is that any transaction subject to withholding tax (“WHT”) that has been or must be recorded as an accrual is deemed as paid for WHT purposes, even if payment has not yet occurred.

Key Highlights

· Accrual basis compliance: Taxpayers must apply CIFRS and record transactions in the period they occur, regardless of payment status. Accrued expenses must be recorded in the purchase journal by referencing the related accrual voucher.

· Withholding tax (“WHT”): Accrued expenses subject to WHT must be declared and paid monthly. Overpaid WHT can be offset in future months; underpaid WHT must be settled.

· Prepayment of income tax (“PIT”): Accrued income is subject to monthly PIT.

· Value added tax (“VAT”): No input VAT credit may be claimed on accrued expenses until the actual tax invoice is received from a VAT-registered supplier.

· Adjustments for discrepancies: Differences between accrued and actual amounts require offset or additional payment.

· Voucher requirements: Taxpayers must record accrued income or expenses using a formal voucher containing at least:

- Voucher title

- Voucher number and date

- Account code and sub-account code

- Debit and credit amounts

- Description

- Preparer’s name, signature, and date

- Approver’s name, signature, and date

· Penalties: Accrued amounts must be estimated based on historical data, comparable transactions, or proportional allocation. Misstatement or fraudulent accruals to reduce tax base are subject to penalties under Articles 225, 235, and 243 of the Law on Taxation.

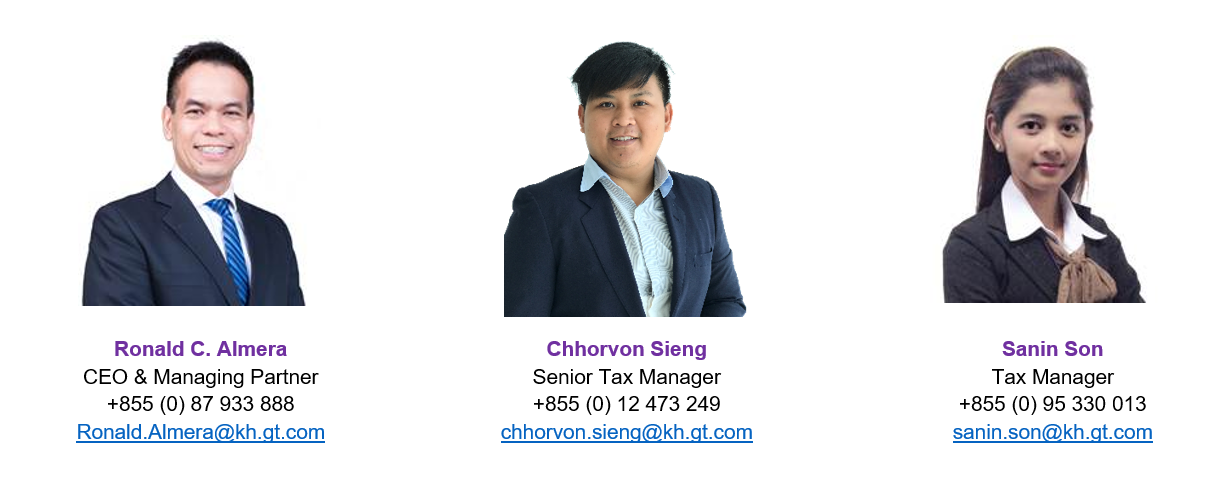

For more details and assistance in reviewing your tax obligations under this instruction, please contact us.